I’ve spent most of my life immersed in the world of electronics, designing circuits, studying systems, and exploring how energy flows through networks of components. Over time, I’ve come to a realization that has shaped the way I see almost everything now: my lifelong passion for electronics is a direct parallel to how social and economic systems function.

I’ve been studying and mapping how electronic circuits and systems mirror the patterns we see in economies. The more I explore, the clearer it becomes that concepts like capital, production, and services have striking equivalents in the behaviors of passive electronic components, capacitors storing charge like reserves of wealth, resistors constraining flow like transaction costs, and inductors creating inertia that resists sudden change.

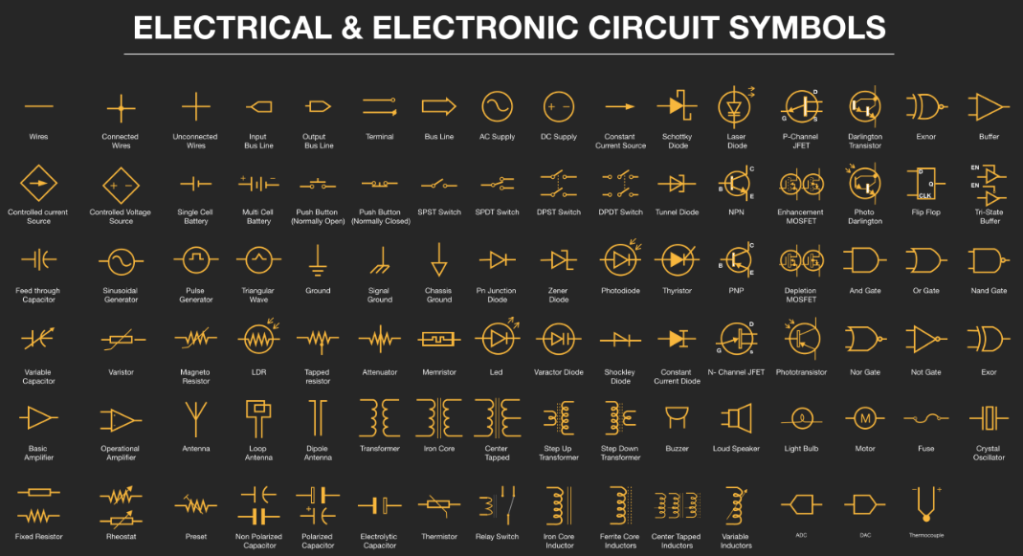

I’ve already written extensively about how human emotions, social interactions, and governance structures can also be represented and understood using the language of electronics symbology. These diagrams and models don’t just make for interesting metaphors, they offer concrete ways to see relationships, bottlenecks, and feedback loops that shape complex systems.

In this blog, I’m presenting these symbols as references for anyone who wants to understand the deep connections between economics and electronics. These analogies can serve as intuitive tools for making sense of economic dynamics, teaching systems theory, or inspiring new approaches to modeling and problem-solving in both fields.

1 – WIRES AND CONNECTIONS

General Description

In electrical systems, wires and connections form the infrastructure of flow, carrying electricity from one point to another.

In economic systems, they represent channels through which money, goods, services, or information move.

These pathways can be open, closed, connected, disconnected, or pooled into larger shared conduits.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Wires | Basic pathways that conduct value—like a trade route, a supply chain lane, or a direct payment from a buyer to a seller. They are the most essential link connecting economic actors. |

| Connected Wires | These symbolize an active, functional link—e.g., an established partnership or contract through which resources flow. They are “live” channels moving value continuously. |

| Unconnected Wires | Latent or potential links that exist but are unused—e.g., a memorandum of understanding or an inactive trade agreement. There is a known path, but no flow is happening until further action. |

| Input Bus Line | This represents a common input channel—like a national tax system collecting diverse revenue streams into one pooled budget. All contributors funnel into the same economic resource. |

| Output Bus Line | The opposite: shared distribution channels—like government spending or welfare payments sent out to multiple recipients from a central treasury. |

| Terminal | An interface point where flows are attached or detached—like connecting a new supplier to a distribution network or onboarding a bank into a payment clearinghouse. |

| Bus Line | A central conduit that aggregates and distributes flows—e.g., SWIFT banking network, a commodity exchange hub, or logistics corridors. All actors plug into this shared infrastructure to route their transactions. |

2 – POWER SOURCES

General Description

In electrical circuits, power sources provide the driving force (voltage or current) that moves energy through the system.

In economic systems, they represent origins of funding, capital, and incentives.

Some power sources are steady and predictable; others are cyclical or adjustable.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| AC Supply | A cyclical funding source, such as seasonal revenue (e.g., agriculture harvest income), or the boom-bust pattern of economic cycles where inflows and outflows rise and fall predictably over time. |

| DC Supply | A steady, constant funding source—like a fixed monthly tax revenue stream or a pension fund’s predictable inflows, maintaining a continuous economic “pressure.” |

| Constant Current Source | An invariable flow of resources, regardless of external factors—e.g., a guaranteed universal basic income or a fixed per-capita subsidy that remains the same no matter the level of demand or economic conditions. |

| Controlled Current Source | A managed funding stream that regulators adjust—like central banks increasing or decreasing quantitative easing programs, or fiscal authorities scaling grants to influence economic activity. |

| Controlled Voltage Source | An adjustable incentive or subsidy that applies constant pressure—similar to targeted interest rate policy that keeps economic momentum steady by adjusting the “potential” rather than the actual flow volume. |

| Single Cell Battery | A small, discrete store of capital, such as a startup’s initial funding or a household’s emergency savings—limited reserves meant for sustaining operations for a short period. |

| Multi Cell Battery | A large, pooled fund combining multiple smaller reserves—like a sovereign wealth fund, pension fund, or diversified investment pool. This is a robust, structured source capable of sustaining large economic demands over the long term. |

3 – SWITCHES AND BUTTONS

General Description

Switches and buttons control whether and how flows are enabled or interrupted.

In economic systems, they represent mechanisms for activating, pausing, or redirecting funding and trade.

They can be manual, automatic, conditional, or discretionary.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Push Button (Normally Open) | A triggered funding mechanism—such as emergency relief funds that remain dormant until an event occurs. When pressed (activated), the economic flow begins. |

| Push Button (Normally Closed) | A normally flowing resource stream that stops when triggered—like an automatic halt in trading if a circuit breaker threshold is breached. |

| SPST Switch | A basic on/off control—like imposing or lifting a trade embargo or halting all transactions in a sector with a single decision. |

| SPDT Switch | A selector switch between two pathways—for example, redirecting budget allocation from defense spending to infrastructure development depending on policy priorities. |

| DPST Switch | A dual on/off control—simultaneously cutting off or enabling two separate funding channels—e.g., freezing both foreign aid and import credits during sanctions. |

| DPDT Switch | A dual selector that shifts two pairs of flows—like rerouting international trade agreements and corresponding domestic subsidies in response to geopolitical changes. |

4 – DIODES AND RELATED

General Description

Diodes and related components control the direction of flow, often enforcing one-way movement or special conditions under which flow is allowed.

Economically, they represent rules, constraints, protections, or targeted mechanisms to regulate how capital, resources, or goods move.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Schottky Diode | A fast-acting economic filter—like automated currency arbitrage that prevents backflow of speculative capital, ensuring rapid, clean flows without delay. |

| Laser Diode | A focused, high-impact funding instrument—targeted grants or subsidies directed at a specific innovation sector (e.g., laser-focused investment into AI development). |

| Tunnel Diode | A mechanism enabling unusual flows under special conditions—for example, negative interest rates encouraging borrowing or capital outflow when conditions in normal markets would prevent it. |

| PN Junction Diode | A one-way control preventing backflow—like capital controls blocking money from exiting a country while still allowing inbound investment. |

| Zener Diode | A safeguard mechanism that activates beyond a threshold—e.g., automatic fiscal stabilizers (progressive taxes, increased unemployment benefits) when economic pressure exceeds certain levels. |

| Photodiode | A signal-sensitive funding trigger—funding that starts only if external indicators are detected (e.g., disaster response funds that disburse upon satellite confirmation of damage). |

| LED | A visible indicator and resource channel—like a public subsidy program that simultaneously provides funding and signals market support to investors (“lighting up” confidence). |

| Varactor Diode | A dynamic adjustment mechanism—like variable credit lines or adjustable mortgage rates that change according to market conditions. |

| Shockley Diode | A threshold-dependent gate—like tax incentives that remain inactive until a company reaches a certain investment level, then unlocks preferential treatment. |

| Constant Current Diode | A fixed-flow guarantee—similar to a flat per-person benefit or automatic annual grant that delivers consistent funding regardless of market fluctuations. |

5 – TRANSISTORS AND FETs

General Description

Transistors and FETs (Field-Effect Transistors) are control devices that act as switches or amplifiers, letting small inputs govern large flows.

In economics, they represent leverage mechanisms—small policy actions or incentives that unlock much larger economic activity.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| NPN Transistor | A facilitator that lets a small control unlock large flows—like microloans enabling large-scale business growth. A tiny policy lever that makes big results possible if the right “bias” (incentive) is applied. |

| PNP Transistor | Similar to NPN but in reverse flow direction—e.g., a subsidy that only flows outward to beneficiaries when internal criteria are met. |

| P-Channel JFET | A controlled restriction—funding can flow but is limited by a gate signal—like licensing regimes that govern how much access a market participant has. |

| N-Channel JFET | A controlled enabler—the default is blocked, and the gate must open it—similar to deregulation: the system unlocks only when regulatory clearance is given. |

| Enhancement MOSFET | Flow starts only when the control signal is applied—like matching grants that don’t provide funding until private investors contribute their share. |

| Depletion MOSFET | Flow exists by default but must be suppressed by a control signal—like automatic subsidies that continue unless the government intervenes to reduce or cancel them. |

| Darlington Transistor | A cascaded amplification chain—a small initial policy change (e.g., tax incentives) creating a multiplier effect that drives significant economic expansion via multiple reinforcing steps. |

| Photo Darlington | Amplification triggered by external signals—like an industry boom driven by sudden global demand, where a small cue (e.g., rising exports) cascades through domestic markets to amplify activity. |

6 – LOGIC GATES

General Description

Logic gates decide how inputs are combined to produce an output, enforcing conditions under which actions occur.

Economically, they are policy rules, decision criteria, and conditional funding mechanisms that evaluate multiple factors before allowing money or goods to move.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| AND Gate | A multi-condition requirement—funding or approval is granted only when all criteria are satisfied (e.g., investment is approved if a project is both profitable and meets environmental standards). |

| OR Gate | A flexible trigger—funding is provided if any one of several conditions is true (e.g., aid is granted if poverty or unemployment exceeds a threshold). |

| NAND Gate | A negated AND condition—resources are blocked only if all conditions are true (e.g., subsidies are withheld only if risk and noncompliance both occur). |

| NOR Gate | A strict block—funding or access occurs only if none of the conditions are true (e.g., project gets support only if no regulatory conflicts and no funding shortfalls exist). |

| NOT Gate | A reversal mechanism—if a condition is true, funding or permission is denied (e.g., sanctions imposed if violations are detected). |

| XOR Gate | An exclusive choice—support is given only if exactly one condition is met (e.g., incentives provided if either domestic sourcing or innovation criteria are met, but not both simultaneously). |

| Exnor Gate | A match requirement—resources flow when conditions are in the same state (both true or both false), like agencies coordinating policy actions only when their assessments agree (either both act or both do nothing). |

| Buffer | A neutral relay—passing inputs forward without modification (e.g., a compliance office that simply forwards applications to funding authorities). |

| Tri-State Buffer | A three-position control—output can be active, inactive, or disconnected (e.g., discretionary spending held in reserve—enabled, disabled, or put into a pending state awaiting further policy decisions). |

7 – WAVE GENERATORS AND SIGNAL SOURCES

General Description

Wave generators and signal sources produce time-varying inputs—cyclical or pulsed patterns that drive behavior.

Economically, they represent recurring funding, one-time stimulus injections, or structured schedules of intervention.

🔹 Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Feed through Capacitor | A filter that smooths fluctuations—like policy mechanisms absorbing short-term volatility in commodity prices while letting stable trends through (e.g., price stabilization funds). |

| Sinusoidal Generator | A cyclical funding or economic cycle generator—like seasonal agricultural subsidies, regular tax collection cycles, or predictable boom-bust market waves. |

| Pulse Generator | A one-time economic stimulus—e.g., an emergency cash injection or a special relief package issued after a disaster to rapidly boost liquidity. |

| Triangular Wave | A gradual ramp-up and ramp-down funding schedule—like phasing in a stimulus over time, reaching a peak, and then tapering off support to avoid overheating the economy. |

8 – GROUND CONNECTIONS

General Description

Ground connections define reference points for voltage measurement and stability in circuits.

Economically, they represent baselines, standards, or shared frameworks that everyone uses for alignment, comparison, or compliance.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Ground | A universal reference level—e.g., a guaranteed minimum standard of living or baseline cost of essential goods, providing a common point of measurement for economic performance. |

| Signal Ground | A specific reference point for relative comparison—like industry benchmarks or sector-specific baselines that individual firms measure their performance against. |

| Chassis Ground | A structural framework grounding the whole system—comparable to a national regulatory environment or legal system that underpins and stabilizes all market activity, ensuring that flows and interactions remain coherent and safe. |

9 – RESISTORS AND RELATED COMPONENTS

General Description

Resistors limit or adjust the amount of flow in a circuit.

In economic systems, they are frictions, constraints, or control measures that shape how quickly and easily capital, goods, or services move.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Fixed Resistor | A constant friction or cost—like standard transaction fees, fixed tariffs, or baseline compliance costs that never change regardless of volume or conditions. |

| Rheostat | An adjustable friction—like variable tax rates or dynamically set tariffs that policymakers can turn up or down to fine-tune economic flow. |

| Preset | A predefined limit—such as fixed quotas or predetermined maximums on production or resource allocation, set during planning. |

| Magneto Resistor | A variable constraint reacting to external factors—like trade restrictions tightening in response to geopolitical events or sanctions triggered by conflict. |

| LDR (Light Dependent Resistor) | A constraint that weakens as demand increases—for example, economies of scale reducing per-unit costs as production volume grows (the more activity, the less relative resistance). |

| Tapped Resistor | Selectable levels of friction—like progressive tax brackets, where different levels apply depending on where you “tap” into the income scale. |

| Attenuator | A deliberate weakening of flow—such as policy tools designed to cool overheated markets by reducing the strength of capital inflows (e.g., tightening credit availability). |

| Varistor | A protection that increases resistance under stress—like capital controls or emergency regulations that automatically kick in when pressure on a currency or system exceeds safe limits. |

| Thermistor | A constraint responsive to “heat”—such as compliance costs or regulatory scrutiny that rise proportionally as economic activity intensifies (e.g., stricter audits during bubbles). |

| Memristor | A component that remembers past flows and adjusts accordingly—like credit scores or institutional memory affecting future borrowing costs (past overuse increases resistance to future access). |

10 – CAPACITORS

General Description

Capacitors store and release energy over time, buffering fluctuations and smoothing out flows.

In economics, they represent reserves, buffers, or pools of capital that can accumulate resources and release them as needed.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Non-Polarized Capacitor | A reserve that can be filled or drawn down in either direction—like general working capital reserves used for any purpose, absorbing surpluses and covering deficits without restriction. |

| Polarized Capacitor | A dedicated reserve that only discharges in a specific direction—such as a fund earmarked exclusively for payouts or project spending (e.g., infrastructure-only capital reserves). |

| Electrolytic Capacitor | A large, high-capacity buffer—like a sovereign wealth fund or strategic petroleum reserve able to store massive value and release it in a crisis. |

| Variable Capacitor | An adjustable reserve whose capacity changes as needed—for example, contingency funds that can be increased or reduced based on changing risk assessments or anticipated needs. |

11 – AMPLIFIERS

General Description

Amplifiers increase the strength of a signal or flow, allowing a small input to create a much larger output.

In economic systems, they symbolize leverage mechanisms or policy multipliers—where modest interventions unlock substantial results.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Basic Amplifier | A simple leverage tool—like matching grants or loan guarantees that make private investors feel confident enough to multiply their investments many times over the initial public contribution. |

| Operational Amplifier | A sophisticated coordination and amplification mechanism—like a central bank that not only injects liquidity but also automatically stabilizes and regulates economic conditions by balancing multiple inputs and constraints in real time. |

12 – INDUCTORS

General Description

Inductors resist changes in flow, introducing inertia that smooths sudden fluctuations.

Economically, they represent structural inertia, adjustment delays, or momentum effects that make systems slow to react.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Iron Core Inductor | Strong inertia resisting rapid change—like established industries or unions that make policy shifts slow and cumbersome. |

| Ferrite Core Inductor | Moderate inertia with some flexibility—for example, supply chains that can adjust but still take time to reconfigure when policies change. |

| Center Tapped Inductor | Inertia that can be split into balanced flows—similar to programs with partially autonomous sub-budgets, where adjustments ripple through multiple dependent systems but stay coordinated. |

| Variable Inductor | Adjustable inertia—like phased policy implementation, where the speed of adjustment can be dialed up or down over time (e.g., planned regulatory rollouts that ease the transition). |

13 – TRANSFORMERS

General Description

Transformers convert flows from one level to another, increasing or decreasing voltage while preserving total power.

In economics, they symbolize mechanisms that re-scale or repackage resources, enabling capital to be adapted to different contexts.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Transformer | A conversion mechanism—like currency exchange that changes funds from one denomination to another while maintaining overall value (e.g., converting dollars to euros). |

| Iron Core Transformer | A high-efficiency converter—such as streamlined foreign direct investment mechanisms that minimize losses and friction when transferring capital between countries. |

| Center Tapped Transformer | A split-output converter—for example, taking a lump sum funding source and allocating it equally to operational and capital budgets, balancing two flows from the same origin. |

| Step Up Transformer | A scaling-up mechanism—like leveraging a small equity stake into a much larger pool of credit for infrastructure investment. |

| Step Down Transformer | A scaling-down mechanism—e.g., distributing a large endowment fund into many smaller targeted grants tailored for individual recipients or regions. |

14 – OTHER COMPONENTS

General Description

This group includes sensors, indicators, converters, and actuators, each performing specialized functions.

In economics, they correspond to signaling mechanisms, communication channels, protective devices, and transformation tools.

Detailed Analogies

| Component | Detailed Economic Analogy |

|---|---|

| Antenna | A broadcast or receiving channel—like economic reports or public communications that send or gather market signals. |

| Loop Antenna | A closed-loop private communication—e.g., confidential negotiations between firms or trade blocs. |

| Dipole Antenna | A balanced two-way communication link—like bilateral trade agreements enabling mutual exchange of information and goods. |

| Relay Switch | A control gate activated by a small signal to allow large flows—for example, regulatory approvals that unlock big investments after a simple compliance certification. |

| Buzzer | An alarm or warning indicator—like early-warning economic indicators that alert policymakers to emerging crises. |

| Loud Speaker | A public announcement system—such as a central bank press conference broadcasting policy changes to the entire market. |

| Light Bulb | A status indicator—e.g., unemployment or inflation dashboards showing current economic health at a glance. |

| Motor | A conversion mechanism turning funding into action—like entrepreneurship transforming capital into goods and services (economic work). |

| Fuse | A protective cutoff—e.g., automatic suspension of trading to prevent systemic collapse during a flash crash. |

| Crystal Oscillator | A precision timing reference—like predictable fiscal reporting cycles or monetary policy review dates anchoring expectations. |

| Phototransistor | A flow regulator responding to external stimuli—such as investments that scale up automatically in response to rising global demand. |

| Flip Flop | A bistable policy toggle—like a government switching between austerity and stimulus modes depending on macroeconomic indicators. |

| ADC (Analog to Digital Converter) | A translator converting qualitative signals into quantitative data—for example, sentiment surveys becoming actionable metrics for funding decisions. |

| DAC (Digital to Analog Converter) | A translator converting data-driven decisions into real-world outcomes—like algorithmic allocation of resources translating into concrete budget disbursements. |

| Thermocouple | A sensor measuring environmental conditions to guide decisions—e.g., economic “temperature” gauges that influence when to tighten or loosen policy (such as overheating warnings driving rate hikes). |

These analogies can serve as intuitive tools for understanding economic dynamics, teaching systems theory, or inspiring innovative modeling techniques in both fields.

Leave a reply to zrpradyer Cancel reply