Below is an in-depth breakdown of the BIS article, where it’s steering the global financial architecture, and how it may reshape humanity today (BIS Webpage link):

The next-generation monetary and financial system

The Digital Trap Is Being Set

We are standing on the edge of a financial transformation disguised as progress.

The Bank for International Settlements (BIS) and its global partners are not just redesigning how money moves, they are redefining the rules of human behavior, access, and control through programmable, tokenised currency systems embedded with biometric ID, ESG mandates, and compliance logic.

At first glance, it promises faster payments, seamless integration, and smarter contracts. But beneath the architecture lies a deeper blueprint: a system where your ability to spend, save, or transact is no longer yours by right, but by permission.

This isn’t just about money. It’s about conditioning the public to accept a world where dissent is de-banked, movement is geofenced, and compliance is encoded into every digital coin.

If we don’t question it now, we won’t be able to opt out later.

1. What It Is (According to BIS Website)

Tokenisation & Unified Ledger

- The BIS envisions a next-generation monetary system built on tokenization, representing assets (bank reserves, deposits, bonds) as programmable tokens on a single platform known as a unified ledger, possibly using DLT.

- This system allows atomic transactions (debit, credit, settlement all at once), reduced delays, automated compliance (AML/CFT), and programmable contracts (like delivery-versus-payment).

Three Pillars: Singleness · Elasticity · Integrity

- A robust monetary system must ensure:

- Singleness – one money accepted at face value by all.

- Elasticity – flexibility in payment and credit provision.

- Integrity – strong safeguards against fraud, crime, and abuse.

- Tokenized central bank reserves underpin trust and guarantee singleness; tokenized commercial bank money supports elasticity; tokenised government bonds complete the system by enhancing liquidity and collateral utility.

Stablecoins vs Tokenization

- The report critiques stablecoins: their issuer-specific nature undermines singleness and elasticity, and their pseudonymous, borderless features challenge integrity and enable illicit use.

- In contrast, tokenized money backed by central banks preserves core monetary foundations while bringing modern functionality.

2. Where It’s Leading

Key BIS Projects: Agorá, Pine, Promissa

- Project Agorá explores cross-border transfer of tokenized central bank and commercial money across seven jurisdictions and multiple banks.

- Project Pine simulates tokenized monetary operations, like smart‑contracted repos and interest settlements.

- Project Promissa tokenizes government promissory notes, removing manual burdens and increasing transparency.

A Vision for the Future

- The vision is one where central banks and the private sector co-design a programmable financial system that preserves monetary trust and stability while enabling faster, cheaper, and more automated transactions across borders and markets.

3. Impact on Humanity & Today’s Affairs

| Area | Impact |

|---|---|

| Efficiency & Cost | Lower cross-border payment costs (estimated ~60% savings compared to remittances via stablecoins). Programmable contracts reduce friction in securities and repo markets. |

| Financial Inclusion | Tokenized systems may allow non‑banks access to central bank money, improving inclusion and sparking innovation. |

| Compliance & Integrity | Built-in identity checks and AI-enhanced AML create more secure, compliant systems, reducing illicit use. |

| Monetary Policy & Stability | Real-time tokenized operations allow central banks to inject liquidity and adjust policy swiftly. |

| Sovereignty & Dollarization | Maintaining central-bank‑issued tokens helps preserve monetary sovereignty. Overreliance on private stablecoins – often US dollar‑denominated – risks “stealth dollarization.” |

4. Bigger Picture for Humanity

- Enhanced trust and coordination: By reinforcing the trust in money (singleness), society avoids past pitfalls tied to unsound currencies.

- Greater technological resilience: Smart contracts and unified ledgers streamline outdated systems, reducing human error and risk.

- Evolving economic ecosystems: Portable and programmable money enables innovations—from micro-insurance triggers to direct public payments.

- Critical role for public sector: Central banks must lead, not just regulate, to ensure these systems serve public goals, not just private profit.

The BIS is charting a path toward a digitally-native monetary and financial system, one that combines trust and stability with speed, programmability, and inclusion. It’s a transformation with far-reaching consequences for how we transact, save, invest, and govern money in today’s interconnected society.

The BIS envisions a globally interconnected system, but not a single, global ledger. Instead, it proposes a network of interoperable unified ledgers, each managed by its own jurisdiction (central bank or authority), but linked via shared standards and protocols. Here’s what that means in detail:

Key Points:

1. Not One Ledger, but Many Interoperable Ones

- Each central bank or monetary authority would have its own “unified ledger”.

- These ledgers integrate tokenized central bank money, commercial bank deposits, and assets like bonds.

- Interoperability is enabled via shared data architectures, standards, APIs, and legal frameworks.

2. Global Interconnectivity via Projects like Agorá

- Project Agorá (BIS Innovation Hub + 7 central banks) aims to link multiple domestic systems for cross-border payments.

- This creates a “network of ledgers”, not one master ledger, like the internet of money systems.

3. Programmable Interoperability

- Smart contracts and “atomic settlement” across ledgers allow for synchronized financial actions.

- Cross-border repo, FX, securities trading, and payments can occur without intermediaries, using common protocols.

4. Governance and Sovereignty Are Preserved

- Each country retains control over its monetary system, so it’s not a supranational currency (unlike IMF SDR or Libra/Diem).

- Central banks remain the issuer and guarantor of their domestic tokenized currency.

Implications for Humanity

| Benefit | Concern |

|---|---|

| Faster, cheaper global transactions | Centralized technical standards may become gatekeepers |

| Preserves national monetary sovereignty | De facto coordination may lead to global policy harmonization (soft control) |

| Reduces risk of dollarised stablecoins | Could pressure smaller nations to adopt BIS-sanctioned systems |

| Enables transparent compliance | May enable real-time surveillance and programmability of funds |

No, it will not be one single global ledger.

Yes, it will be a globally connected network of unified ledgers, each operated by a sovereign central bank, but integrated through shared standards to enable seamless cross-border and inter-asset transactions.

What’s Holding Up Implementation of the BIS Unified Ledger System?

Main Bottlenecks and Barriers

| Category | Specific Barrier | Details |

|---|---|---|

| Legal & Regulatory | Fragmented jurisdictions | Each country has unique AML/CFT laws, privacy rules, monetary policy controls, and central bank mandates. Coordinating these is politically slow. |

| Privacy & Sovereignty | Data localization vs global integration | Nations want control over citizen data and financial activity. The BIS proposes “federated learning” as a compromise, but trust is not universal. |

| Technical Interoperability | Lack of mature shared infrastructure | Atomic settlement across ledgers requires globally agreed message formats, API specs, and contract standards. These are still in design/testing (ISO 20022, Project Agorá). |

| Legacy Infrastructure | Core banking systems are old | Most commercial banks still run on decades-old COBOL-based systems. Migration or integration with tokenized ledgers is expensive and risky. |

| Private Sector Buy-In | Risk of disintermediation | Commercial banks fear losing revenue streams if programmable central bank money bypasses them. BIS counters with tiered architecture, but trust needs time. |

| Monetary Power Dynamics | U.S. dollar dominance | A unified system could reduce dollar hegemony in FX and reserves. This causes geopolitical hesitation from dominant powers. |

| Proof of Value & Safety | Pilot projects still ongoing | Projects Agorá, Promissa, Pine, Icebreaker, etc., are proofs-of-concept. Real deployment requires years of audit, testing, and failover readiness. |

Estimated Timeline (Based on BIS Roadmap)

| Phase | Description | Approx. Timeframe |

|---|---|---|

| 2023–2025 | Pilot projects & interbank tests (Agorá, Promissa, mBridge) | Ongoing now |

| 2025–2027 | Regulatory alignment + technical rollout in a few countries | Slow but progressing |

| 2027–2030 | Gradual global adoption, especially for G7/G20 cross-border transfers | Likely target for “critical mass” |

| Post-2030 | Full-scale global interoperation via harmonised ledgers and standards | Only if geopolitical and commercial hurdles are resolved |

Realistic full global integration ETA: 2028–2035 (depending on geopolitical alignment and private sector modernization).

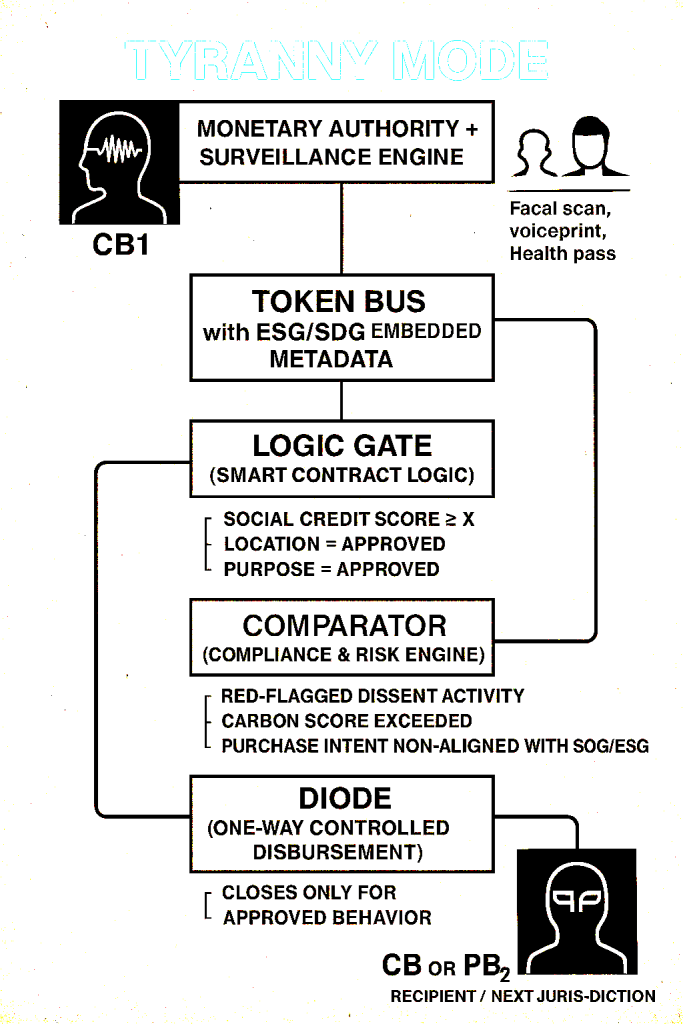

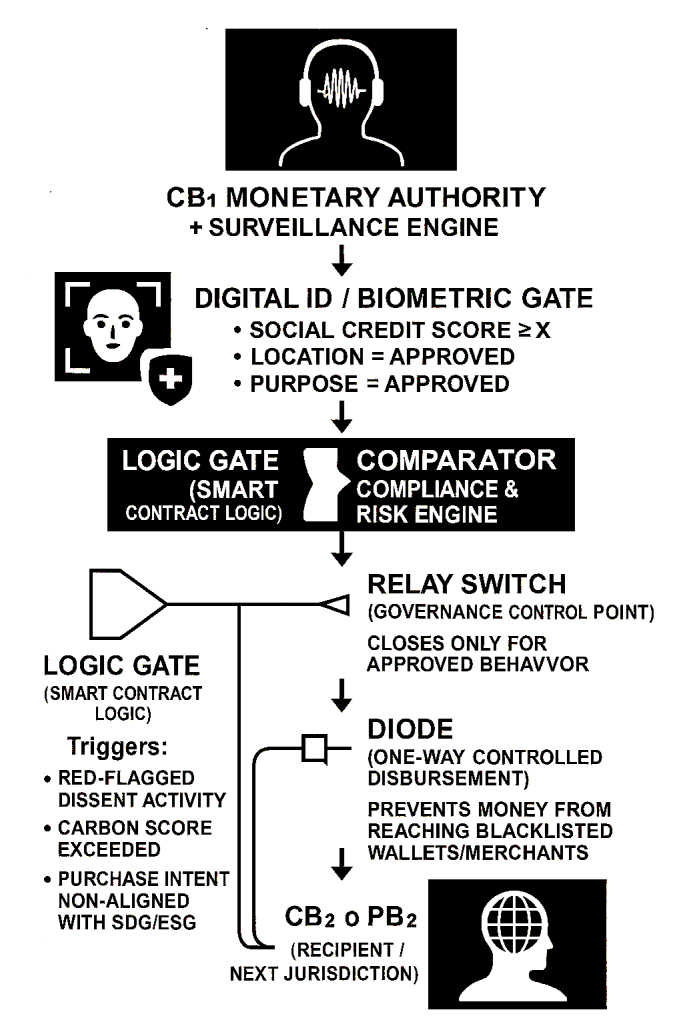

Circuit Analogy: The Unified Ledger System

Here’s a conceptual circuit analogy using symbolic standard electronics:

SYSTEM OVERVIEW

Key Analog Components:

| Circuit Component | Analogy in BIS Architecture |

|---|---|

| Voltage Source | Central bank: source of trust (tokenised reserves = stable voltage) |

| Logic Gate | Smart contracts: control transactional flows (settlement if conditions met) |

| Bus | Common messaging standard (ISO 20022): allows signals (tokens/data) to move between nodes |

| Multiplexer / Router | Interoperability bridge: routes data to correct national or private ledger |

| Diode | Compliance layer: allows legal flow only in one regulatory direction (AML gate) |

| Capacitor | Token buffer: stores liquidity temporarily during atomic settlements |

| Oscillator | Monetary policy engine: adjusts liquidity programmatically over time |

| Relay Switch | Governance decision points: rules enforced per jurisdiction |

| Comparator | AML risk engine: compares identity/transactions against thresholds (red flags) |

Here is the detailed explanation of the circuit diagram based on the BIS unified ledger architecture and the electronics analogy:

Central Banks (CB1 and CB2) = Voltage Sources

- CB1 and CB2 represent sovereign central banks.

- They act as voltage sources in the system, injecting trust (voltage = tokenized reserves).

- CB1 shows a wave-based brain (symbolizing algorithmic trust or monetary policy engine), while CB2 has a networked globe (suggesting global compliance or cross-border interface).

Private Banks (PB1 and PB2)

- PB1 and PB2 are private commercial banks.

- They connect directly to their respective central banks’ partitions and share data through the Token Bus.

- Gears symbolize automated processing and programmatic compliance logic.

Token Bus = Common Protocol / Messaging Standard

- Acts like a data backbone (ISO 20022) that allows all components, banks, central banks, smart contracts, to exchange tokens, payment orders, and rules.

Logic Router = Smart Contracts / Transaction Filters

- The logic gate connected to the token bus routes the transaction flow.

- AND gate logic: both PB1 and CB1 must signal validity for a token to move.

- Downstream elements determine what happens only if certain conditions are met (atomic settlement logic).

Compliance Diode = One-Way Legal Flow

- The diode ensures signals (tokens) can only move in compliant, regulated directions (AML restrictions).

- Non-compliant data or unauthorized flows get blocked here.

Comparator = Risk & Identity Verification

- Evaluates signal conditions (transaction volume, origin, identity) against preset thresholds.

- If risks exceed bounds (red flags), signals are diverted or halted before reaching the relay.

Oscillator = Monetary Policy Injection

- Symbol in lower-left represents a cyclical input (liquidity injection or rate signaling from CB1).

- Mimics central bank interventions over time (interest rate setting, liquidity windows).

Capacitor = Token Buffer

- Stores and smooths transaction energy during intermediate settlement phases.

- Prevents system overload when atomic settlements stack up.

Relay = Governance Switch

- Decides final transaction approval.

- Represents jurisdiction-specific legal or regulatory decision points.

- Activates only if Comparator and Logic Router pass the transaction.

Final Output: Cross-Border Gate to CB2/PB2

- If all stages succeed (legal, logic, compliance, monetary conditions), the transaction crosses the border atomically from PB1/CB1 → PB2/CB2.

This is a Federated Authoritarian System

Here’s a detailed analysis of how the BIS unified ledger system, as represented by the circuit diagram, could be used, or repurposed, under authoritarian governance structures with embedded surveillance and social engineering tools:

THE CIRCUIT AS A CONTROL GRID

The system can, under authoritarian design choices, be weaponized into a behavioral enforcement system. Here’s how each part would adapt in such a regime:

KEY TECHNOLOGICAL COMPONENTS UNDER AUTHORITARIAN CONTROL

| Circuit Element | Neutral Function | Authoritarian Reuse |

|---|---|---|

| Voltage Source (CB) | Central bank injects trusted token reserves | Only compliant citizens or “verified identities” receive liquidity, based on behavior, biometrics, or political views |

| Token Bus | Shared messaging protocol (ISO 20022, API) | Global surveillance spine for financial behavior logging, used across jurisdictions |

| Logic Gate (Smart Contract) | Atomic settlement based on transaction validity | Rules include social credit score, vaccination status, political alignment, ESG score, or alignment with UN SDG |

| Comparator | Risk engine for AML/KYC | Compares biometric or behavioral profile to blacklists, triggers denial if outside regime standards |

| Relay Switch (Governance Decision) | Final approval layer for transaction | Activates only for users in good standing; can be flipped permanently for dissidents or flagged groups |

| Diode (Compliance Gate) | Prevents illicit flow | Turns into a one-way access control for privileges (food, travel, healthcare) |

| Oscillator (Policy Engine) | Injects or absorbs liquidity over time | Dynamic rationing tool, linked to carbon scores, energy usage, or political loyalty |

| Capacitor (Token Buffer) | Holds tokens during operations | Used for delays or penalties, token freezing for low ESG compliance or political dissent |

AUTHORITARIAN ENFORCEMENT FLOW

- Digital Identity + Biometrics

- Every user must authenticate via national digital ID, possibly linked to facial recognition, palm scans, iris, etc.

- This ID is mapped permanently to your wallet (tokens are no longer anonymous).

- Programmable Money

- Money becomes conditional:

- Can only be spent on “approved” goods

- Expires if unused by deadline

- Geofenced to specific areas or merchants

- Disabled during protest or civil disobedience

- Examples:

- Can’t buy red meat if carbon score too high

- No travel tokens if unvaccinated or flagged

- Charity donations only allowed to state-approved causes

- Money becomes conditional:

- UN SDG / ESG Integration

- Every token transaction carries embedded metadata:

- What it was spent on

- Who was paid

- Whether the purpose aligned with SDG goals (gender equality, carbon neutrality, etc.)

- Non-compliant behavior = penalty or reduced social/credit score

- Every token transaction carries embedded metadata:

- Cross-border Denial

- System can enforce international sanctions instantly:

- Money/asset flow between two wallets in “non-aligned” states fails at the logic/comparator stage

- Blacklisted individuals/entities experience total financial cut-off

- System can enforce international sanctions instantly:

GEOPOLITICAL USE: “GLOBAL SOCIAL CONTROL FABRIC”

- China, EU, BRICS+, and other blocs could each deploy national instances of the BIS system, fully compatible with each other but governed locally.

- Countries with high surveillance infrastructure will program it with aggressive compliance logic (China’s social credit model).

- Western countries may outsource the coercion to private ESG scoring firms, or quietly enforce compliance through “smart” contracts in financial instruments.

EXAMPLE SCENARIOS

1. Citizen Tries to Travel

- Digital ID checks biometric match → passes

- Comparator detects low political compliance score (posting against the regime) → relay switch cuts off ticket payment

- Tokens for fuel or train are denied at the diode

2. Purchase Groceries

- Tokens check logic for approved dietary carbon quota

- Red meat exceeds monthly ration → transaction denied

- Food tokens automatically redirected to insect protein product store

3. Share Dissent on Social Media

- Surveillance AI logs event → linked to wallet via digital ID

- Oscillator modifies liquidity injection → wallet only receives 30% of next month’s UBI

- Delay capacitor holds balance pending “civic re-education compliance”

The unified ledger is a neutral infrastructure, but programmable money turns it into a compliance operating system.

Under authoritarian regimes, or under technocratic soft totalitarianism, it becomes a circuit of perfect economic coercion.

Tyranny Mode Circuit Overlay – Interpretation

This version of the BIS circuit architecture assumes authoritarian configuration, where all programmable elements are retooled for population control and compliance enforcement.

Modified Circuit Path: “Tyranny Mode”

Key Modifications:

| Original Component | Authoritarian Mod | Effect |

|---|---|---|

| Voltage Source | Tied to biometric ID | No token access without biometric match |

| Logic Gate | Includes behavior/policy filters | Transactions depend on social/political compliance |

| Comparator | Enhanced with AI surveillance feed | Real-time cancellation of “risky” transactions |

| Relay Switch | Remote kill-switch | Blocks access for political dissent |

| Diode | Enforces sanctions & geofencing | Blocks spending in disapproved areas or vendors |

| Oscillator | Adjusts liquidity via behavior analytics | “Good citizens” get faster settlement, more credit |

Examples of What the Tyranny Mode Circuit Blocks:

- Donations to non-approved charities

- Travel during restricted political events

- Purchases deemed anti-ESG (fossil fuels, red meat, ammo)

- Cross-border trade with sanctioned peers

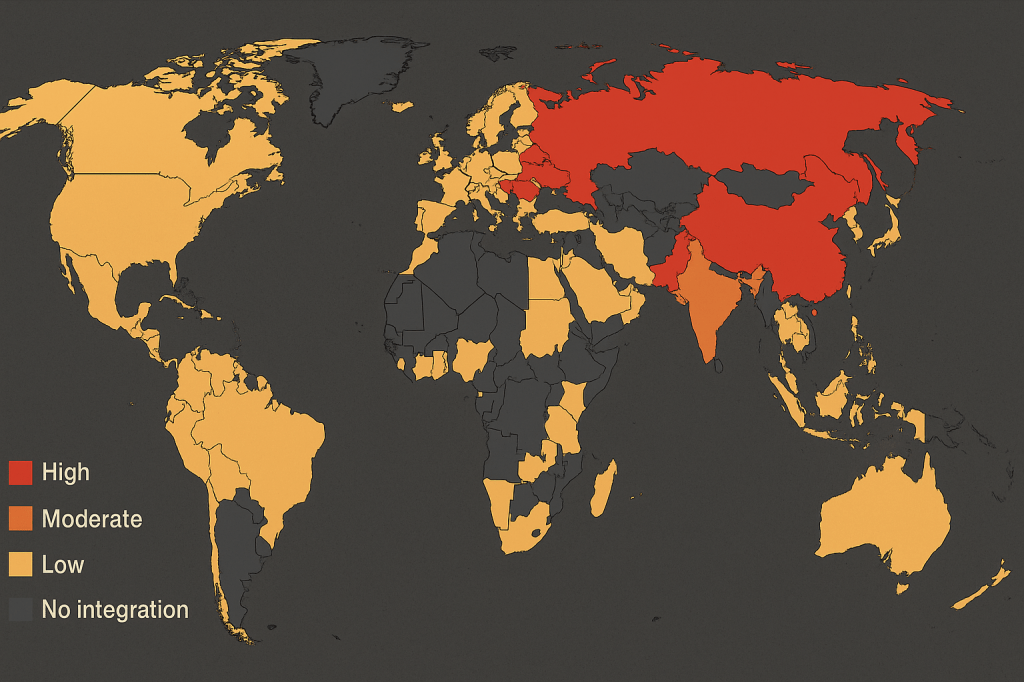

Top Countries Integrating Programmable Money + Surveillance

Here’s a detailed breakdown of the countries most advanced in integrating programmable money with surveillance infrastructure, ranked by readiness and implementation status as of mid-2025.

| Rank | Country | Description of System | Key Technologies |

|---|---|---|---|

| 1 | China | Digital Yuan (e-CNY) is live in multiple cities and fully programmable. Integrated with social credit system, real-name digital ID, facial recognition, and geofencing. | – CBDC (PBoC controlled) – Social credit integration – Biometric ID – “Dual offline” NFC payments |

| 2 | India | e-Rupee under phased rollout; Aadhaar biometric ID and Unified Payments Interface (UPI) already linked to citizen accounts. Cross-system surveillance potential is high. | – e-Rupee pilot – Aadhaar/UPI stack – DigiLocker (digital documents) |

| 3 | European Union | Digital Euro under accelerated design; ESG compliance-by-design and integration with eIDAS (digital identity) and Green Deal. Strong focus on transaction traceability for carbon compliance. | – Digital ID wallet – ESG reporting laws – CBDC sandboxing – ISO 20022 |

| 4 | Brazil | Drex (Digital Real) in pilot phase with emphasis on smart contract enforcement and financial inclusion. Close ties with SDG-linked social policies. | – Pix + Drex combo – Social registry integration – ESG data pilots |

| 5 | Nigeria | eNaira launched but underperforming due to public distrust. However, tight integration with BVN (Bank Verification Number) and NIN (National ID Number) gives surveillance leverage. | – eNaira wallet – National biometric ID – SIM-NIN integration |

| 6 | Russia | Digital Ruble pilot expanding, with dual-mode smart contracts and geopolitical sanction-resilience as goals. Infrastructure allows programmable controls by region or merchant. | – Biometric passport linkage – Military-civilian firewall features – Cross-border BRICS DLT R&D |

| 7 | Turkey | CBDC and biometric digital ID being piloted alongside AI-driven transaction anomaly detection. Ties to UN SDG goals for ESG-compliant smart subsidies. | – TROY payment system – CBDC pilot – National biometric ID |

| 8 | Saudi Arabia & UAE | GCC-wide CBDC being tested under mBridge (BIS) with heavy compliance tooling and SDG-aligned AI logic. ESG filters being developed. | – mBridge (cross-border BIS tech) – Digital ID + face-scan mandates |

| 9 | United States | FedNow is operational for instant payments; no official CBDC yet. However, ESG scoring (via private institutions) and surveillance by proxy (IRS, FinCEN) suggest soft integration. | – FedNow – KYC + OFAC integration – ESG via BlackRock, MSCI |

| 10 | South Korea | Actively testing a CBDC with smart contract functionality and integration with Korean Digital New Deal (data sovereignty, digital welfare programs). | – Digital ID wallet – CBDC pilot – Surveillance-enabled welfare targeting |

- China, India, and the EU are functionally the most prepared to enforce programmable compliance-based money.

- Many other countries are adopting a “soft totalitarian” model, outsourcing surveillance to private ESG scoring firms or data brokers.

- Cross-border infrastructure (like BIS’s mBridge or Agorá) is enabling these systems to interoperate globally—under “federated” control.

A System of Control Masquerading as Innovation

What the BIS is building is not merely a financial upgrade, it’s a civilizational pivot.

Behind the sleek language of efficiency, inclusion, and innovation lies a programmable apparatus of total behavioral enforcement. With every transaction mapped, every identity verified, and every coin coded with rules, we risk constructing an invisible panopticon, one where your access to money, movement, and participation in society hinges on your compliance with shifting political, environmental, and ideological mandates.

This system has the capacity to silently erase dissent, geofence disobedience, and algorithmically punish the non-conforming, not through overt violence, but through the simple denial of access.

The danger is not in the code, it’s in the hands that write it.

If we sleepwalk into this future under the illusion of convenience, we may wake up in a world where freedom is no longer default, but programmable, issued, revoked, or expired like tokens on a ledger.

“If you want a picture of the future, imagine a boot stamping on a human face, forever.”

—George Orwell, 1984

“A really efficient totalitarian state would be one in which the all-powerful executive of political bosses and their army of managers control a population of slaves… who love their servitude.”

—Aldous Huxley, Brave New World Revisited

“In the name of safety, we traded freedom. In the name of efficiency, we lost autonomy. In the name of digital trust, we gave up our right to dissent.”

Leave a reply to wrenchinthegears Cancel reply